The envelope budgeting system most people are used to using makes you write down your monthly income and then list out all of your spending categories and what you spend on each one, per month. It also makes most people hate budgeting, and for good reason.

Here are some of my main problems with that system…

Who in the world spends on a monthly basis?

Do you get paid monthly? Do you do monthly groceries? Most of us get paid semi-monthly or bi-weekly, we may do groceries once a week, and have random one-off expenses here and there. A system that forces you to think in terms of monthly spending just isn’t natural.

Envelope budgeting is not very flexible.

In the real world, shit happens that doesn’t fit neatly into your budget. If you just found out your car needs the brakes replaced and that it’s going to cost you $400, you just broke your neatly put together “monthly plan.” It sucks when that happens. And then what? How will that one-off brake expense actually affect what you can spend money on later on?

Envelope budgeting won’t help you there, because its focus is only on the present, not the future.

Here’s a crazy idea…What if instead of creating a monthly budget, you could just track the future weekly balance of your checking account?

You could enter your repeating expenses and how often they occur (e.g., bi-weekly), enter any one-off expenses as they occur, and just watch what that does to your weekly balance weeks or months in advance.

Wouldn’t that be a lot easier than having to stick to some monthly “plan” that rarely works out as written? Isn’t your balance what really matters?

I used the envelope approach for years until my wife finally convinced me to switch to her forecast budgeting method. She used a spreadsheet which obviously had its limitations.

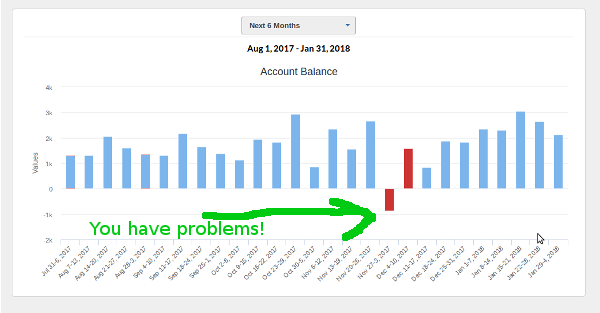

Then I created Kualto.com, a web and phone app that lets you track your weekly checking account balance, showing you what bills will be due on any given week up to 3 years going forward! It also sends you bill reminders.

If you need to spend $400 on new brakes and you see that your balance will not go negative in the next 12 months, you are good! Nothing broken. No going “over budget.” No guilt. You simply spent some money and knew you could afford it.

If on the other hand you see that after spending $400, your account will go negative (and by how much) a couple of weeks, or a couple of months from now according to your estimates, you know how long you have to fix the problem by shifting things around or whatever the case may be.

The same is true for your savings. Want to see if you can afford to save an extra $400 per month? Enter it as a repeating “expense” and see what happens to your future balance.

What’s so great about this?

- It’s less restrictive and more ‘big-picture.’ Rather than try to confine yourself to some monthly plan, you just make sure your balance never goes negative. Just by doing this you will be meeting your savings goals as well as making sure your bills are paid on time. A lot simpler isn’t it?

- It’s more motivating! With Forecast Budgeting you can see what your account balance will be months from now, if you stick to your plan. Yeah, the future is obviously not fixed, but getting an idea of where you could be, and being able to see that in a chart makes “budgeting” more fun and will motivate you to stick with what you’re doing.

Try out Kualto free for 30 full days and see what you think. Like me, you may never want to put on the shackles of traditional budgeting again. It will literally take you two minutes to see the power of it.